Business loans for startups are essential financial tools that can help kickstart a company’s operations. They provide necessary capital for expenses such as equipment purchases. Rental costs. Employee salaries. Inventory, & other operational costs. These loans are often offered by banks. Credit unions & online lenders. With different interest rates. Repayment terms, & eligibility criteria. Getting a business loan can support startups in achieving their initial business objectives. Leading To growth & profitability. It’s pivotal To ensure The loan terms align with your business plan & financial capability.

Business loan for startup. Secure a steady future for your startup with our flexible business loans. Easy application. Fast approval, & competitive rates. Start today!

Understanding Business Loans for Your Startup

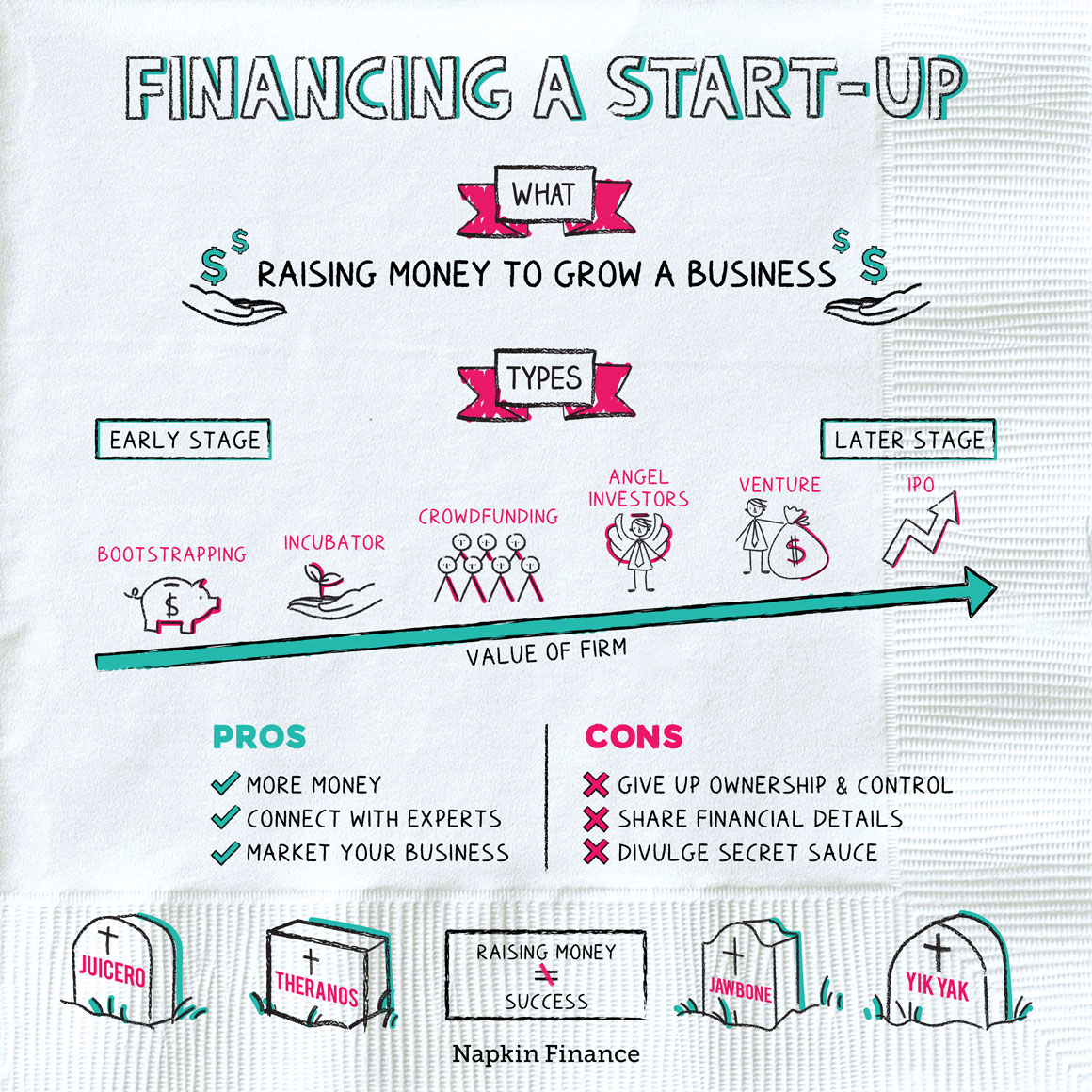

When starting a fresh commercial venture. The foremost hurdle frequently centers around raising sufficient capital. For many entrepreneurs. Acquiring a business loan emerges as one viable way of funding startups. From acquiring basic equipment. Employing workers, securing a favorable location. Or merely having a financial safety net. These loans can be used for various needs.

These loans are primarily designed for supporting business growth. Hence are tailored exclusively for. Commercial purposes. Interestingly. These loans are not tied specifically to the age of a business. Meaning startups. And even business concepts. Can successfully secure such a loan. As long as they meet the lender’s requirements.

Nevertheless. Acquiring a business loan for startups entails satisfying a set of criteria and navigating an oftendaunting application process. From credit scores. To collaterals and business plans. The journey towards securing a business loan necessitates meticulous planning and execution.

Types of Business Loans for Startups

Numerous types of commercial loans cater to a diverse range of business needs. For instance. Small business loans are designed principally for small businesses. Aiming to either launch or expand. On the other hand. Equipment loans are ideal for financing the purchase of machinery.

Other common types of business loans include merchant cash advances. Where lenders advance businesses an lump sum of money. With a percentage of sales being used for loan repayment. There are also business lines of credit. Which provide flexibility similar to credit cards. Allowing businesses to borrow money within a specific limit.

Interestingly. There is no onesizefitsall solution when it comes to choosing the perfect loan for a startup. Each loan type comes with its own set of terms. Rates and eligibility requirements. Hence. Understanding each one thoroughly becomes crucial before settling on one.

Advantages of Business Loans for Startups

Possessing a business loan can fuel the growth of startups in several ways. Offering a host of advantages. First off. Maintaining a business loan allows your company to tap into extra funding without surrendering equity. This implies that entrepreneurs will retain complete control over decisions and profits.

Moreover. These kinds of loans offer flexible repayment plans. Loans sometimes come with an option to adjust the repayment plan based on the business’s financial health. This means startups can decrease or increase their repayment installments based on their profitability.

Additionally. Securing a business loan enables startups to access funds in a quick and efficient manner. While also facilitating the creation of a positive credit history. Which can prove beneficial for future borrowing needs.

Quick highlight of Business Loan Features

- 📚 Access extra funds without surrendering equity.

- 🔒 Various loan types to cater to a diverse range of business needs.

- 📈 Flexible repayment terms to easily manage loan repayments.

- ⏱️ Fast and efficient disbursement of funds.

- 📊 Ability to help build a positive credit history.

SelfExperience with Business Loan for Startups

Over the years. My business managed to secure a business loan. Assisting us in realizing our broad vision and executing critical projects. The entire experience provided us with new perspectives on how these loans could propel startups towards achieving their goals whilst minimizing financial strain.

Comparing Various Business Loans for Startups

| 🏢 Loan Type | 💸 Loan Amount | 💡 Best For |

|---|---|---|

| Small Business Loans | $5. 000 $500. 000 | Launch or Expansion |

| Equipment Loans | $5. 000 $1. 500. 000 | Purchasing Machinery |

| Merchant Cash Advances | $5. 000 $500. 000 | Future Sales |

| Business Lines of Credit | $1. 000 $250. 000 | Flexibility |

Tips for Securing a Business Loan for Startups

To start with. It becomes essential to thoroughly understand your business needs and then identify which loan type aligns best with these needs. This will ensure the loan can satisfy the specific needs of your business. Making repaying the loan a manageable task while pushing the business forward.

Aside from clearly defining the needs of the business. Paying attention to the eligibility criteria becomes critical. This involves acquainting yourself with the lender’s requirements. Reviewing your credit score. And preparing the necessary documents.

Coupled with these tips. It’s essential that startups thoroughly scrutinize the terms of the loans. Particularly the interest rates and extra costs. This step can prevent any future unwelcome surprises. Ensuring a smoother journey towards business growth. For more helpful tips. Feel free to check here.

Business loan for startup

| Features | Traditional Lenders | Online Lenders | Micro-Lenders |

|---|---|---|---|

| Application Process | Lengthy and complicated | Easier and quicker | Relatively simple |

| Loan Amount | Higher | Varies | Lower |

| Interest Rate | Lower | Higher | Varies |

| Repayment Duration | Longer | Shorter | Varies |

| Collateral Requirement | Usually required | Usually not required | Depends on the lender |

| Credit Score Requirement | High | Flexible | Varies |

| Funding Speed | Slower | Faster | Medium |

| Customer Service | Usually good | Varies | Typically excellent |

| Flexibility in Usage | Less | More | Varies |

| Approval Rate | Lower | Higher | Varies |

| Loan Term | Fixed | Varies | Depends on the lender |

| Prepayment Penalties | Common | Varies | Not common |

| Hidden Fees | Less likely | Possible | Less likely |

| Early Repayment Benefits | Usually none | Varies | Varies |

| Loan Purpose Flexibility | Limited | High | Moderate |

| Loan Restructuring Options | Less | More | Varies |

| Documentation | Heavier | Lighter | Moderate |

| Business Plan Requirement | Always | Sometimes | Varies |

| Personal Guarantee Requirement | Usually | Sometimes | Depends on the lender |

| Ease of Access | Less | More | Moderate |

Business loan for startup

What are The qualifications To secure a business loan for a startup?

Generally. A startup business loan requires that you have a strong personal credit score. At least six months in business & preferably more than $50. 000 in annual revenue. Additionally. Most lenders prefer startups that possess a strong business plan. Potential personal collateral, & a demonstrated ability To make consistent financial projections.

Are there specific types of business loans for startups?

Yes. Various types of business loans are suitable for startups. These may include SBA loans. Microloans. Business credit cards. Or even personal loans for business. Different lenders each offer unique products. So it would be appropriate To research & speak To an advisor To understand what product suits your needs best.

What documents are needed To apply for a startup business loan?

A lender will typically require your business & personal tax returns. A statement of personal credit rating & business profitability, & a detailed business plan. Often. Additional documents might include financial documents like bank statements & balance sheets. Legal documents like leases & contracts. Or your proof of collateral.

How long does it take To get approved for a startup business loan?

Depending on The lender & type of loan. It can take anywhere from a few days To a few weeks To get approved for a business loan. The timeline heavily depends on how quickly you can gather & submit your financial documents, & how long The lender’s review process is.

What is The typical interest rate for a startup business loan?

The interest rate on a startup business loan depends on a variety of factors including your credit score. The length of time you’ve been in business, & The profitability of your business. However. Most interest rates fall within The range of 4% To 6% annual interest.

Can I get a business loan for a startup with bad credit?

While it can be more challenging. It is possible. Some lenders are willing To work with entrepreneurs who have lower credit scores. They will likely require more extensive documentation of your business plan & financial projections, & might offer higher interest rates on The loan.

What is The maximum amount I can borrow for a business startup loan?

The maximum amount of a startup business loan can vary greatly. Depending on The lender & your qualifications. However. Most lenders offer amounts between $5000 & $500. 000. Some lenders may offer up To $2 million in financing for wellqualified borrowers.

Can I apply for a startup business loan online?

Yes. Many lenders offer The convenience of online applications for business startup loans. Ensure you have all The required documents in a digital format & check The lender’s website for specific requirements & instructions on how To complete The application.

Conclusion

In conclusion. Getting a business loan for your startup can pave The way for exciting growth & success. It can help To kickstart your venture. Spur development, & manage operating expenses. However. Securing a loan requires thorough planning. Strong financial management, & a compelling business plan. Always compare various lenders To find The best terms. Don’t forget. A business loan is a tool. Not a solution. It’s up To you To make The most of that tool To transform your startup into a thriving business.